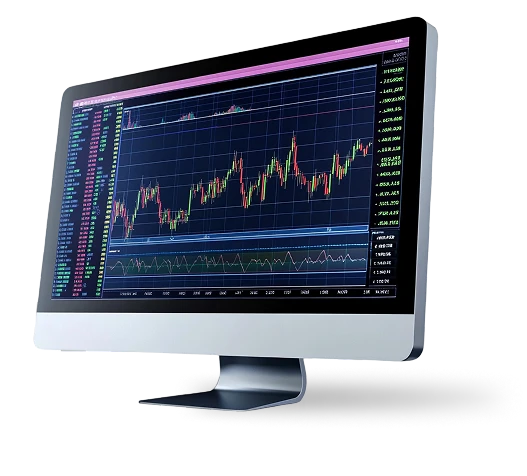

Greymont Luxeron interprets fluctuating crypto movement through layered analytical organisation, reshaping scattered data into structured understanding. Its system maintains equilibrium between short bursts of volatility and gradual momentum shifts, helping users observe rhythm without disruption during uncertain conditions.

Through ongoing observation of market intervals, Greymont Luxeron identifies gradual pattern development that signals potential directional changes. This approach promotes patience and clarity, supporting anticipation of evolving movements before they fully form.

Each analytical review connects historical observations with present metrics, maintaining consistency in directional reading. This continual refinement sharpens comprehension, ensuring users remain aligned with developing structures throughout active and transitional trading periods.

Greymont Luxeron applies real time artificial intelligence to decode shifting asset behaviour into structured context. Each assessment evaluates pace and intensity, distinguishing emerging formations or slowing momentum. Its AI based logic sustains awareness across variable conditions, ensuring clarity remains firm during constant motion.

Greymont Luxeron delivers uninterrupted evaluation through both fluctuating and settled markets. It discards redundant noise while amplifying relevant shifts in structural rhythm. This balance aids consistent reading of digital movement, preserving stable interpretation as tempo and sentiment evolve.

Greymont Luxeron integrates adaptive computation to recognise developing signals across time intervals. It interprets these variations to align market rhythm with factual context. This evolving calibration sharpens awareness and sustains accuracy, offering reliable structure even during intensified volatility. Cryptocurrency markets are highly volatile and losses may occur.

Greymont Luxeron studies market behaviour to reveal how traders sustain composure during unpredictable activity. By analysing the relationship between reaction and strategy, it exposes the methods behind disciplined responses to market shifts. This continuous evaluation shapes balanced perception, enabling consistent awareness throughout changing digital trends.

Within its structured environment, Greymont Luxeron upholds precision across every analytical cycle. The system filters unnecessary noise, ensuring each outcome remains focused on accurate data review. With layered protection and verifiable tracking, users gain dependable analysis throughout varying levels of volatility.

Greymont Luxeron isolates subtle fluctuations within market flow, translating them into measurable insights before broader movement occurs. This fine tuned awareness enhances recognition of emerging patterns, guiding objective interpretation and supporting stable evaluations in active or calm phases alike.

Each recalibration within Greymont Luxeron connects prior observations with live updates, maintaining a continuous rhythm in assessment. This steady alignment sustains dependable conclusions across unpredictable market phases, ensuring interpretations remain informed and unaffected by short lived volatility. Cryptocurrency markets are highly volatile and losses may occur.

Greymont Luxeron decodes live digital patterns into organised interpretation, refining erratic price motion into steady analytical rhythm. Its layered evaluation framework translates scattered reactions into contextual clarity, supporting measured observation over impulsive response during evolving trading environments.

With continuous data assessment, Greymont Luxeron captures the rise and decline of market pace before transitions become apparent. Each evolving stage is recorded as part of an ongoing analytical cycle, providing awareness that sustains direction during both stable and unpredictable intervals.

Greymont Luxeron observes cyclical structures that signal possible turning movements. These recognitions divide fleeting noise from lasting developments, building perspective that highlights genuine transformation over temporary variation in digital activity.

Greymont Luxeron preserves steady perception across each analytical pass, connecting live readings with verified historical context. Its process reinforces disciplined evaluation and ensures comprehension remains reliable through variable trading circumstances.

The operational grid within Greymont Luxeron simplifies assessment through logical sequencing. Each analytical point links to accessible data flow, allowing continuous study without distraction. This structure supports ongoing refinement and uninterrupted evaluation across dynamic market cycles.

Greymont Luxeron advances interpretation by dividing digital market behaviour into structured layers of insight. Its analytical framework filters unstable variations and forms organised pathways of data, ensuring a steady view of directional flow through both active and calm market intervals.

Through continuous mapping, Greymont Luxeron synchronises current momentum with historical evaluations to preserve consistency. This balance keeps observation grounded in data rather than impulse, supporting calm judgment even when volatility tests stability across the trading landscape.

Each analytical tier within Greymont Luxeron functions under constant review to uphold accuracy and operational reliability. As cryptocurrency markets are highly volatile and losses may occur, Greymont Luxeron provides measured guidance built on disciplined structure and sustained analytical awareness.

Greymont Luxeron transforms dispersed crypto data into cohesive interpretation, refining irregular market behaviour into structured understanding. It tracks evolving activity to reveal rhythm and directional flow, guiding traders toward clarity instead of reaction. The system maintains steady analysis, ensuring consistent perception during both rapid and moderate market conditions.

At its foundation, Greymont Luxeron merges real time evaluation with a stable interpretive balance. It converts fragmented signals into measurable outlines, sustaining awareness through each stage of price motion. This alignment allows accuracy to remain firm through alternating volatility cycles.

Greymont Luxeron connects shorter fluctuations with long term sequences to deliver layered perspective. While immediate reactions may influence tempo, its adaptive observation model integrates these movements into broader context. This structure strengthens confidence and steadiness through all phases of digital asset variation.

Through refined analytics, Greymont Luxeron recognises gradual or abrupt liquidity changes before they become visible in large scale trends. This enables users to detect potential strength or decline early, maintaining composure and informed awareness through shifting conditions.

By examining recurring formations, Greymont Luxeron isolates consistent behavioural structures that repeat during market adjustments. These observations highlight transformation zones, equipping traders with foresight to interpret rhythm and anticipate subsequent phases with stability.

Greymont Luxeron ensures unbroken monitoring across fluctuating environments. It removes redundant variations while preserving verified data streams, supporting dependable interpretation even during unstable intervals.

Greymont Luxeron decodes irregular crypto fluctuations into structured form, distinguishing short bursts of volatility from stable market trends. Its multi layered framework preserves continuity during unpredictable phases, helping users interpret direction with measured focus and steady perception across changing cycles.

Through consistent evaluation, Greymont Luxeron identifies momentum buildup or deceleration before broader movement occurs. Each signal is transformed into practical analysis, maintaining clear judgment during shifting patterns. Reliable scanning keeps interpretation stable through both quiet and dynamic conditions.

By sustaining ongoing review, Greymont Luxeron ensures dependable evaluation as digital motion fluctuates. This continuous oversight strengthens reliability, reinforcing balance and structured awareness through evolving crypto environments.

Market sentiment often shapes how participants react to instability. Greymont Luxeron reads the relationship between confidence and hesitation, translating emotional cues into measurable context. It identifies behavioural tendencies that emerge as digital conditions alter, supporting understanding grounded in logic rather than reaction.

During waves of optimism or restraint, Greymont Luxeron tracks pace and intensity to determine the underlying rhythm. This structure allows recognition of market tone before full momentum changes develop, guiding disciplined awareness through both advancing and corrective stages.

Using AI computation and behavioural mapping, Greymont Luxeron builds a cohesive analytical base. It refines shifting emotional data into consistent understanding, maintaining clarity and structured observation through volatile adjustments.

External financial and policy fluctuations can redirect asset behaviour. Greymont Luxeron analyses these developments to understand how international movements influence digital valuation. It aligns macroeconomic cues with regional metrics to sustain reliable analysis in fast changing conditions.

As global activity evolves, Greymont Luxeron observes interconnections that link external and domestic outcomes. This awareness supports comprehension of broader triggers affecting short term cycles and valuation patterns.

By integrating worldwide reference data, Greymont Luxeron extends its analytical depth beyond individual markets. The platform contextualises volatility within a global framework, maintaining balanced interpretation while users navigate transitions influenced by international change.

Consistent understanding depends on detecting rhythm within activity, a process Greymont Luxeron achieves through adaptive intelligence. By linking live data flow with behavioural tracking, it identifies evolving shifts, maintaining balanced awareness through variable trading cycles.

Greymont Luxeron observes gradual accelerations and decelerations across multiple phases to indicate potential turning moments. These readings sustain structured awareness and prevent reactionary decision making, allowing users to interpret change with composure through unstable markets.

Within its organised design, Greymont Luxeron observes pacing and rhythm across defined intervals, refining the timing of analytical responses. This alignment system maintains precision during irregular trading conditions, supporting focused evaluation and balanced interpretation even through fluctuating data volumes.

Through continuous mapping, Greymont Luxeron detects repeating behavioural patterns that hint at directional change. These recurring signals highlight areas of momentum stability or disruption, reinforcing consistency in observation and enabling users to stay centred during market variation.

Greymont Luxeron analyses engagement strength by comparing interaction levels and energy flow within live sessions. These correlations merge behavioural pace with structured analysis, forming dependable benchmarks that guide interpretation of both short term movement and extended cycles.

By translating live updates into well organised analytical layers, Greymont Luxeron preserves continuity throughout alternating momentum. This structure promotes dependable understanding during both acceleration and slowdown, ensuring each phase remains traceable and logically connected within overall market rhythm.

Greymont Luxeron integrates multiple analytical layers to translate market variability into structured understanding. By filtering out erratic impulses and linking immediate fluctuations with long range developments, it provides users with a coherent reading of overall market direction during uncertain or unstable periods.

Through progressive data structuring, Greymont Luxeron establishes a disciplined base that promotes accuracy and focus. Its organised framework nurtures steady interpretation, ensuring analytical alignment and preserving clarity as trading environments evolve.