Finsdex Morebit, dalgalanan piyasa aktivitesini organize analitik katmanlara dönüştürerek düzensiz hareketleri tutarlı yorumlanabilir dizilere dönüştürür. Her segment görünürlüğü arttırır ve güvenilir değerlendirmeyi desteklerken dış sistemlere bağımsız çalışır.

Finsdex Morebit içinde hizalama işlemi, yükselen davranış sinyallerini sürekli bir analitik yoluna entegre eder. Katmanlı ayarlamalar bozulmayı azaltır ve orantılı yapıyı korur, böylece tüm değerlendirmeler dış etkilerden arınmış ve tarafsız kalır.

Finsdex Morebit içinde tahmin edici sıralama, geçişsel değişiklikleri sabitleyerek tutarlı ritimle analitik tempoyu yönlendirir. Katmanlı iyileştirme netliği pekiştirir, sakinliği korur ve evrilen piyasa davranışı boyunca yapılandırılmış perspektifi güçlendirir.

Finsdex Morebit, değişken piyasa davranışını yapılandırılmış analitik katmanlara dönüştürür, düzensiz hareketleri orantılı dizilere çevirirken tümüyle değişim sistemlerinden bağımsız kalır. Katmanlı AI işleme, değişen desenleri geliştirir, güvenilir netliği sağlar ve evrilen koşullar boyunca tutarlı yorumlamayı destekler.

Finsdex Morebit içinde yapısal akıl, işlem ağlarına bağlı olmadan analitik sürekliliği sürdürür. Her kalibre edilmiş katman doğruluğu arttırır, dinamik aktivite sırasında dengeli değerlendirmeyi destekler ve piyasa gözlemi her aşamada tarafsız, önyargısız bir içgörü sağlar.

Finsdex Morebit, dinamik piyasa davranışını yapılandırılmış analitik katmanlara dönüştürür, tamamen ticaret veya borsa sistemlerinden bağımsız kalırken tarafsız ve güvenilir içgörü sağlar. Katmanlı gerçek zamanlı AI sıralama, odaklanmayı, netliği ve tutarlı anlayışı tüm piyasa gözlem aşamalarında korur.

Finsdex Morebit, düzensiz piyasa davranışını yapılandırılmış analitik katmanlara dönüştürerek tutarlı ve bütüncül değerlendirme oluştururken herhangi bir yürütme veya borsa mekanizmasından tamamen bağımsız kalır. Her katmanlı ayarlama netliği artırır, görünürlüğü korur ve evrilen piyasa koşulları boyunca güvenilir içgörüyü destekler, işlem etkileşimi olmaksızın.

Finsdex Morebit, dalgalanan piyasa davranışını organize analitik katmanlara dönüştürerek tarafsız bir değerlendirme sunar ve tümüyle dış yapılarından bağımsız kalır. Katmanlı AI işlemesi netliği korur, objektifliği pekiştirir ve tutarlı yorumlayıcı içgörüyü destekler, evrilen piyasa koşulları boyunca kararlı bir anlayış sağlar.

Finsdex Morebit, değişken piyasa sinyallerini yapılandırılmış değerlendirme katmanlarına dönüştürerek düzensiz hareketleri tutarlı yorumlayıcı dizilere dönüştürür. Koordine edilmiş AI işleme orantılı netliği korur ve değişen piyasa koşulları boyunca tutarlı bir değerlendirme sağlar.

Finsdex Morebit içinde katmanlı hesaplama, ardışık desenleri ve ilişkisel verileri eşzamanlı hale getirerek güvenilir bir analitik çerçeve oluşturur. Otonom modüller, odaklı gözlemi ve kesintisiz netliği sürdürür; uzun süreli piyasa faaliyetleri boyunca güvenilir bir değerlendirmeyi destekler.

Finsdex Morebit, dalgalı piyasa faaliyetini yapılandırılmış analitik katmanlara yeniden düzenler; dağınık sinyalleri tutarlı yorumlayıcı dizilere dönüştürür. Her dizi, koşullar değiştikçe sabit değerlendirme desteği olan dengeli bir ritim oluştururken ticaret sistemlerinden bağımsız kalır.

Finsdex Morebit içinde katmanlı AI işleme, gelişen piyasa faaliyeti arasında tekrarlanan hareket desenlerini belirler; gürültüyü filtreleyerek önemli trendlere vurgu yapar. Konsolide girişler yapılandırılmış analitik katmanlar oluşturur, yorumlamanın tutarlı ve işlem sistemlerinden bağımsız kalmasını sağlar.

Finsdex Morebit, makine destekli sıralamayı uygulayarak ortaya çıkan piyasa davranışını düzenli katmanlara dönüştürür. Tekrarlanan desenler yakalanır ve istikrarlı hale getirilir, hızlı ve yavaş dalgalanmalar boyunca netliği korur. Bu uyum sağlayıcı yaklaşım güvenilir bakış açısını güçlendirir ve kesin yorumu destekler.

Finsdex Morebit içinde ardışık AI değerlendirmesi, değişken faaliyeti orantılı analitik yapılar haline getirir, kısa ve uzun süreli gözlem için akışı ve zamanlamayı düzenler. Her kalibre edilmiş katman, değişen piyasa yoğunluğu boyunca netliği, dengeyi ve yapılandırılmış anlayışı korur.

Finsdex Morebit, koordineli yorumlayıcı yolaklara kararsız piyasa hareketlerini yönlendirerek netliği ve odaklanmayı artırır. Katmanlı değerlendirme, orantılı değerlendirmeyi ve disiplinli bakış açısını sürdürerek, evrilen koşullar boyunca sürekli analitik tutarlılık sağlar.

Finsdex Morebit, değişken piyasa faaliyetini yapılandırılmış analitik katmanlara dönüştürerek, dağınık hareketleri tutarlı yorumlayıcı dizilere dönüştürür. AI rehberli modelleme dinamik trendleri orantılı desenlere dönüştürür, hızlı ve yavaş değişiklikler boyunca güvenilir anlayışı destekler.

Finsdex Morebit içinde katmanlı hesaplama, organizeli analitik dizilere yönelik yönetsel değişiklikleri ayarlar ve ticari sistemlerden tamamen bağımsız kalır. Koordine edilmiş akıl, karmaşık hareketi orantılı katmanlara dönüştürerek sürekli yorum akışını korur ve evrilen koşullar boyunca netliği sağlar.

Finsdex Morebit içinde sürekli AI desen tanıma, analitik doğruluğu arttırır. Her kalibre edilmiş katman, orantılı yapısı güçlendirir ve yorumlama netliğini sağlamlaştırır, dinamik piyasa davranışı boyunca düzenli anlayışı sürdürür. Tüm çıktılar sadece bilgilendirici olup ticari faaliyete girişmez.

Finsdex Morebit, dinamik arayüz verilerini yapılandırılmış analitik katmanlara dönüştürerek değişen girdileri düzenlenmiş görsel dizilere çeviriyor. Katmanlı ayarlamalar, hem hızlı güncellemelerde hem de daha yavaş aralıklarda sorunsuz geçişleri sağlar, netliği korur ve gelişen bilgilerin tutarlı yorumunu destekler.

Yenilikçi hizalama Finsdex Morebit'de dağılmış unsurları sürekli analize uyumlu bütünsel bir yapıya entegre ederek sorunsuz bir şekilde yanıt veren bir çerçeve oluşturur. Düzen, boşluk ve sıralamanın kademeli kalibrasyonu yapılandırılmış sunumu sürdürür, yorumlama derinliğini artırır ve sürekli izleme sırasında kesin gözlem yapmayı sağlar.

Finsdex Morebit, karmaşık gelen pazar verilerini yapılandırılmış analitik katmanlara dönüştürerek dağınık sinyalleri bir araya getirir ve tutarlı, okunabilir dizilere dönüştürür. Koordineli işleme, ham girdileri net formatlara dönüştürerek görünürlüğü artırır ve etkili değerlendirmeyi mümkün kılar.

Finsdex Morebit'deki etkileşimli bileşenler, veri kümelerini netlik ve bilgi derinliği arasında dengeleyerek orantılı düzenlerle yönlendirir. Her bölüm belirli bir boşluk korur, karışıklık olmadan detaylı analize izin verir ve verimli, gerçek zamanlı değerlendirmeyi destekler.

Zamanlanmış hizalama Finsdex Morebit'de arayüz öğeleri boyunca sabit bir ritmi sağlar, hızlı güncellemelere sorunsuz bir şekilde uyum sağlar ve anlayışı bozmadan sürekli olarak adapte olur. Koordine sıralama sürekliliği pekiştirir, odaklanmayı sürdürmeye ve etkin gözlem sırasında güveni koruma konusunda yardımcı olur.

Finsdex Morebit, analitik unsurları birleşik bir katmanlı çerçeveye entegre eder. Yapılandırılmış organizasyon güvenilir rehberlik sağlar, netliği korur ve evrilmekte olan pazar faaliyetinin sürekli izlemesi için güvenilir bir yorumsal yol sunar.

Finsdex Morebit, değişken pazar faaliyetini yapılandırılmış analitik katmanlara dönüştürerek hızlı ve düzensiz hareketleri koherent yorum dizilerine çevirir. Koordineli AI hesaplamaları momentum değişikliklerini, duraklamaları ve gelişen desenleri yorumlar ve işlem sistemlerine bağlı kalmadan net içgörüler sunar.

Sıralı işleme Finsdex Morebit'de gelen verileri orantılı analitik katmanlara hizalar, hızlanan, yavaşlayan veya tutarsız faaliyetlerde netliği korur. Her ayarlama dengeli yorumlamayı sağlar, tamamen gözlem temelli güvenilir anlayışı destekler.

Finsdex Morebit'deki öngörüsel AI modellemesi, davranışsal geçişleri yapılandırılmış analitik dizilere dönüştürür. Makine tabanlı desen tespiti düzensiz sinyalleri koherent bir temsil haline getirir, hassasiyeti artırır ve pazar koşulları evrildikçe sürekli değerlendirmeyi mümkün kılar.

Finsdex Morebit, anlamlı faaliyetleri arka plan gürültüsünden ayırmak için AI destekli öğrenme kullanarak ince pazar dalgalanmalarını değerlendirir ve aksi takdirde tespit edilmeyen gelişen yapıları ortaya çıkarır. Bu katmanlı yaklaşım, evrilen pazar aşamalarında öngörü yeteneğini artırır.

Finsdex Morebit içinde gerçek zamanlı işleme, kademeli trendleri ve yönsel değişimleri orantılı analitik sıralamalara dönüştürür. Tarihsel davranışlar, canlı sinyaller ile birleştirilerek tutarlı haritalama oluşturulur, ortaya çıkan trendler vurgulanırken tarafsız gözlem korunur.

Finsdex Morebit içinde yapılandırılmış katmanlama, karmaşık pazar faaliyetlerini tutarlı analitik derinliğe dönüştürür. Zamanlama, ritim ve momentumu takip ederek her katman, ince sinyalleri odak haline getirir, değişen pazar koşulları boyunca yapılandırılmış yorumlama ve güvenilir desen tanıma desteği sağlar.

Finsdex Morebit, değişken pazar faaliyetlerini katmanlı analitik sıralamalara dönüştürür, eşitsiz davranışı yorumlara dönüştürürken ticaret sistemlerine tamamen bağımsız kalır. Sürekli AI destekli işleme netliği artırır ve değişen koşullar boyunca istikrarlı değerlendirme sağlar.

Mevcut pazar kalıpları, Finsdex Morebit içinde değişkenlik dönemlerinde tutarlı anlayışı sürdürmek için doğrulanmış davranış referansları ile hizalanmıştır. Katmanlı ayarlamalar hızlı hareket eden değişimleri sabit sıralamalarla entegre eder, istikrarlı analitik akış üretir ve evrilen aşamalar boyunca sürekliliği koruyan güvenilir analiz akışı oluşturur.

Finsdex Morebit içinde sıralı AI modelleme, gelen sinyalleri yapılandırılmış analitik bağlamda düzenler, ortaya çıkan trendlerin tanınmasını iyileştirir. Her rafinaj, dağınık girişleri tutarlı bir analitik çıktıya dönüştürür, yorumlama hassasiyetini güçlendirir ve devam eden pazar dinamikleri boyunca güvenilir içgörüyü destekler.

Finsdex Morebit, düzensiz faaliyeti düzenli yorum katmanlarına dönüştürmek için gerçek zamanlı pazar sinyallerini yapılandırılmış analitik referanslarla birleştirir. Bu orantılı yapı, tutarlı netliği korur ve değişen yoğunluk seviyeleri boyunca güvenilir içgörüyü sağlar.

Finsdex Morebit içinde katmanlı değerlendirme, ince dalgalanmaları, zamanlama değişikliklerini ve yön değişikliklerini birleşik analitik sıralamalara entegre eder. Yapılandırılmış yaklaşım, hızlı hareketler sırasında sürekli anlayışı korur, sürekli ve güvenilir yorumlama desteği sağlar ve evirilen pazar koşulları boyunca kesintisiz devamı korur.

Finsdex Morebit, düzensiz pazar hareketlerini yapılandırılmış analitik katmanlara dönüştürerek, değişen koşullar arasında tutarlı yorumlamayı sağlar. Her kalibreli sıra eşitsiz faaliyeti filtreler, netliği ve güvenilir gözlemi koruyan tutarlı bir çerçeve oluşturur ve evirilen senaryolar boyunca devamı sağlar.

Finsdex Morebit içinde zamanlanmış AI modelleme, büyük trendler oluşmadan önce ince yön değişikliklerini tanımlar. Her ayar, tutarsız sinyalleri ölçülebilir sıralamalara dönüştürür, tamamen gözlemle temellendirilmiş yapılandırılmış analiz üretir. Bu öngörücü yaklaşım, desen tanımayı artırır ve sistematik değerlendirmeyi destekler.

Piyasa faaliyeti hızlandığında veya yavaşladığında, yükselen korelasyonlar daha belirgin hale gelir. Finsdex Morebit, gelişen sinyalleri organizatör analitik katmanlara hizalamak için sürekli yeniden ayarlama yapar, dağınık girişleri yapılandırılmış yorumlamaya dönüştürür. Her tekrar, hassasiyeti pekiştirir ve uzun süreli izleme sırasında sürekliliği korur.

Entegre AI modelleme içinde Finsdex Morebit, Tüm analitik katmanlarda orantılı hizalandırmayı sürdürür. Uyumlu sıralama düzensiz değişiklikleri yapılandırılmış döngülere dönüştürür, hızlı dalgalanmalar ve uzun süreli gözlemler sırasında netliği korur. Kripto para piyasaları oldukça volatildir ve kayıplar oluşabilir.

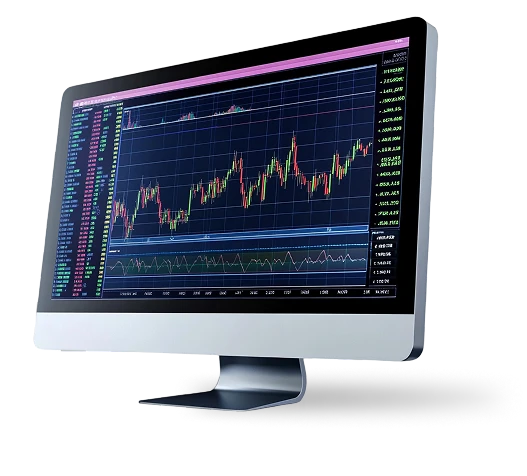

Finsdex Morebit, karmaşık piyasa verilerini katmanlı görsel dizilere dönüştürerek, farklı aktivite seviyeleri arasında tutarlı yorum netliği sağlayan düzenli yollar oluşturur. Koordineli bölümler odaklanmayı yönlendirir, yoğun girdileri net, yapılandırılmış ekranlara dönüştürerek analitik anlayışı artırır.

Finsdex Morebit içinde katmanlı hizalama, arayüz elemanlarını oransal olarak düzenleyerek düzgün sıralamayı korur. Kalibre edilmiş aralıklar, grafikler, metrikler ve dinamik paneller arasında okunabilirliği koruyarak hassas gözlem ve kesintisiz gerçek zamanlı güncellemeler sırasında güvenilir gezinmeyi destekler.